This is part of a sponsored collaboration with Prudential and DiMe Media. However, all opinions expressed are my own.

I just returned from Miami – from Hispanicize 2018 and full of life insurance tips. Let me explain! As always, the week-long event went by too fast and was jam-packed with activities. From concerts to seminars to networking, my head is still swirling with excitement. It’s going to take a few days to settle down and process it all. And better yet, implement all I learned to benefit all of you guys!

My biggest takeaway was being a Prudential ambassador! I’ve had this position in the past and have always shared about saving and investing money. But this time around, things were different. I dove into the world of life insurance.

Truth is, I became very emotional talking about this topic. I didn’t have life insurance (I’m finally getting it this week). I didn’t grow up learning about it from my family, then when I did, I postponed it and forgot. LAME excuse.

My friend, Anjelica, Crafty Thrifter, told me a story about how her sister passed away and had let her life insurance lapse and the stress it put on her family. I don’t like to let fear guide me, but I do want to make smart decisions about my future – and that of my family. Whatever I can do to plan ahead, I’m game.

Check out my video to see my interview with him! His name is Tomas, and I’d love for him to date my daughter…just sayin…! 🙂

Here are the three biggest reasons to buy life insurance Tomas mentioned:

- Protection. For as little as $20-40 a month (it is different for each person), you can sleep well knowing you are covered in case anything awful happens. Your kids will be able to use that money to cover expenses for your debts, mortgage, etc.

- Retirement. This blew my mind – I had no idea! You can actually add extra retirement funds!

- Legacy. Leaving money behind for loved ones.

You can see these tips and more on the Prudential site. That’s what I did! Here are some helpful articles:

Visit the site to get a quote and find a local agent who can help you.

This is what I loved most about the Prudential area at Hispancize. As a freelance content creator, money is always on my mind to grow my business. But having an area at this event to go and speak with finance experts and long-term vision was eye-opening. We can’t just think about this month’s bills, or this year’s income, or even a five-year plan. We have to think beyond that!

Check out these findings from a recent Prudential report on Americans and Money:

- 71% of middle-income Hispanics feel they are behind on preparing for retirement as opposed to 63% of the general population.

- 49% of Latinos say they don’t understand how to save and invest appropriately for their

situation - 59% of Latinos are unsure about who to go to for financial advice and guidance

- Men indicate much higher amounts of total savings ($54K) than women (19K)

What’s wrong with this picture? We need to empower and educate ourselves, ASAP! I’ve never felt more motivated than ever! Follow #Prupárate and #Prupact to see other ambassador posts. We all lead different lifestyles and have different needs, so it’s interesting to what area each of us were drawn to!

Another area that interested me was the #80yearoldmilliennial display

In the year 2068, what will life be like for Millennials? Will technology become disruptive or

welcomed? Could imagining the seismic shifts to come, help us pave pathways to prosperity for the

future? Our landmark study, “The 80-Year- Old Millennial”, uncovers ways to help Millennials and

policy influencers approach issues across health, wealth, technology and work. Prudential

commissioned a study from Kantar Futures. Futurists in tech, transportation, education and aging

compiled the questions. The 1,000 Millennials polled helped us identify challenges and opportunities

they anticipate.

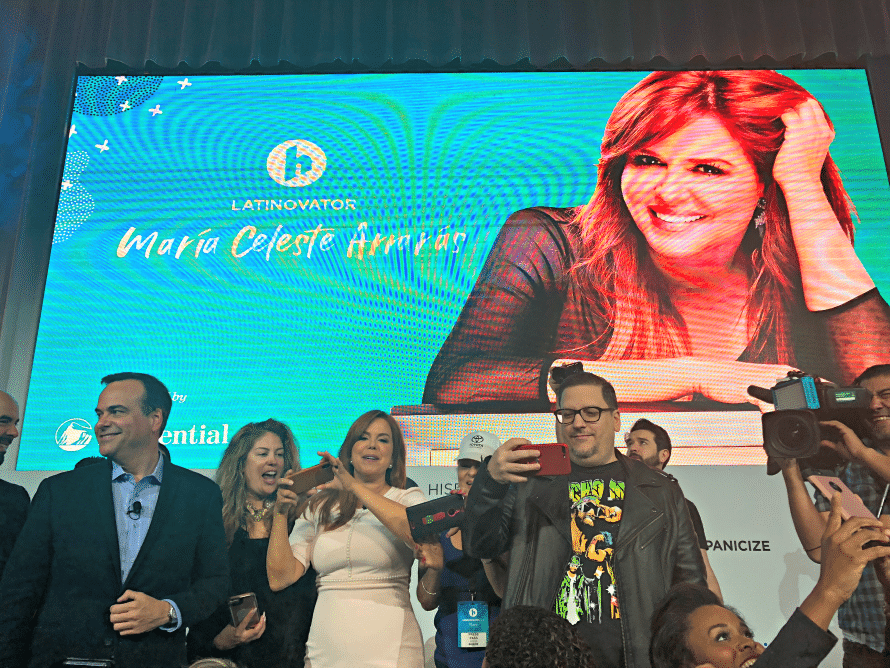

In addition to the activation area, Prudential also hosted a number of other events, like the Latinovator Award Breakfast and the Positive Impact Awards!

Thanks so much for reading! The next Hispanicize is in Los Angeles in the fall, stay tuned!